Best Way to Invest Money: For a Salaried Employee

Best Way to Invest Money: Know How to Invest Money the Best Way

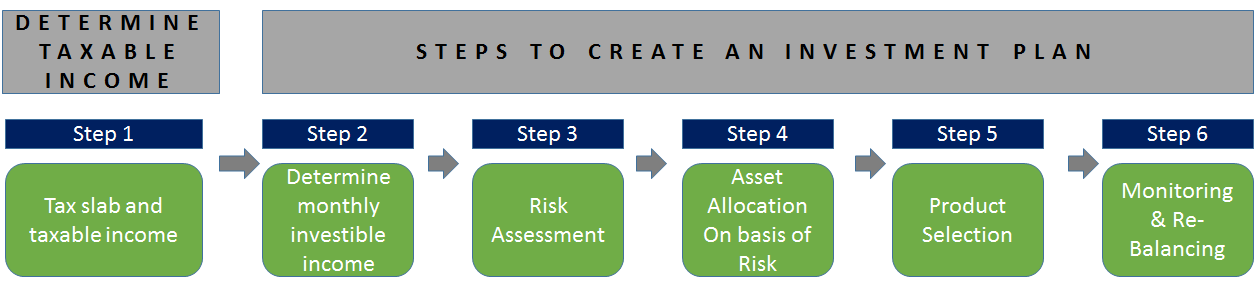

Step 1: Determine Taxable Income and Make Tax Savings Investments

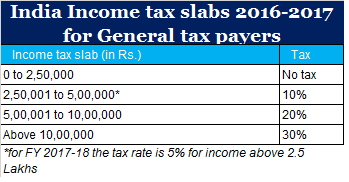

Let’s take an example that your income being 4Lakhs, so what will be your tax bracket.

10% of 1.5 Lakhs = INR 15,000 (this will drop to half in FY 17–18 since tax rate is 5%, however, your income will also change)

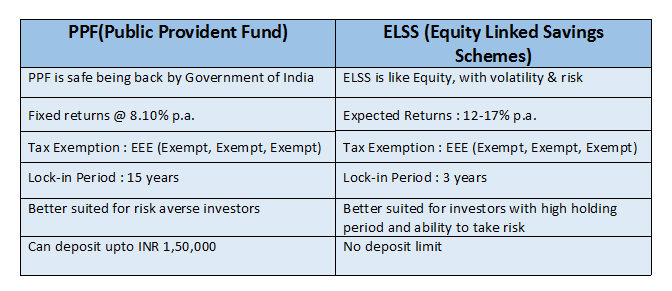

Since we have determined the taxable income, we need to ensure that we make the relevant tax saving investments (as per various sections of income tax act, Section 80C, 80D etc.). One can choose from a number of options like ELSS, health insurance, ULIP, etc. These are all long-term investments and should be chosen after a careful consideration. An ELSS (also known as Equity Linked Savings Scheme) is a hot favourite due to its relatively lower lock-in period of 3 years.

A comparison of ELSS and PPF (Public Provident Fund) is below:

Step 2: Determine Monthly Investible Income

The next step would be to determine your monthly surplus that you can invest. This should be determined after taking into account your take home salary and expenses. One should also have some funds aside for contingency needs or emergency expenses.Step 3: Risk Assessment

Risk assessment is an important step and one should determine the same. The ability to take risk depends on many factors such as age, cash flows, ability to tolerate loss etc. One would need to determine basis these if one can take a high risk or moderate risk or low risk.Step 4: Asset Allocation

This is simply deciding the mix of assets in a portfolio, for e.g. a high risk taking investor can have more equity in the portfolio than a low-risk investor. A basic rule of thumb is 100 minus age of investor to be the equity allocation. Rest to be in debt.Step 5: Product Selection

After determining allocation, the next step is to ensure we choose the right products to get into. Mutual funds could be a good route to invest money since they are professionally managed, regulated by SEBI (Securities and Exchange Board of India) and are convenient to enter and exit.- Ratings of mutual funds published by rating agencies such as CRISIL, MorningStar, ICRA are good starting points for funds that can be selected.

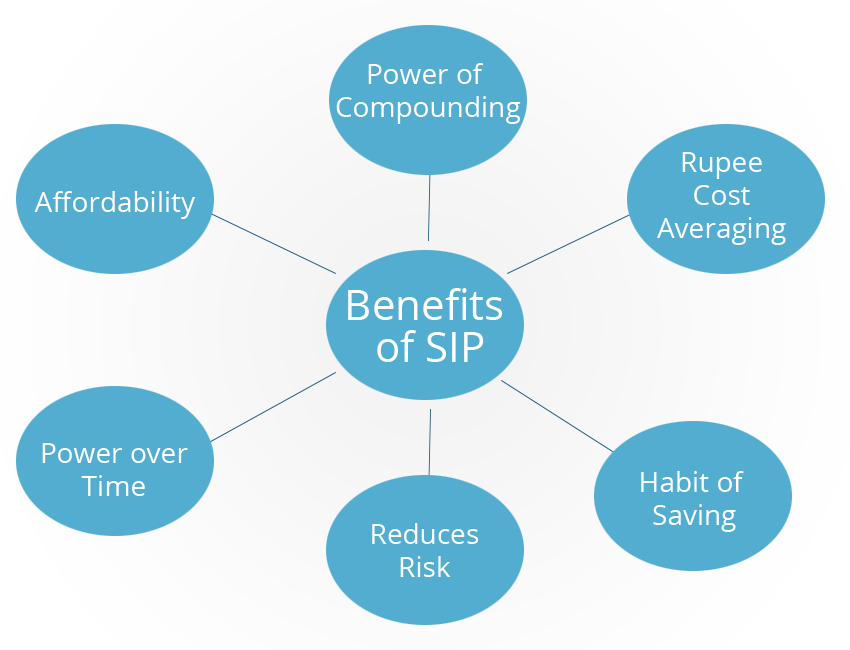

- SIP or Systematic Investment Plan could be a good option for salaried employees, which provides convenience to the investor and is a one-time setup while the further investments are automated.

Step 6: Monitoring and Rebalancing

After making investments, it is not over by a big margin. To make sure that you get good returns it is required to monitor the portfolio at least once in 3 months and ensure you rebalance once a year at a minimum. One would need to see scheme performance and also that good performer exists in the portfolio. Else changes need to be made to the holdings and replace laggards with good performers.These are the basic steps to be followed to make an effective and efficient plan. If one does this and monitors the holdings over time, it should yield good results. Best of luck!

No comments:

Post a Comment

Thanks for visiting the blog. Your comments are welcome.