I’ve lost a lot of money in the stock market recently.

I’m an optimist, but seeing a lot of money disappear isn’t the most fun thing. So after the latest drop in stocks over the past few weeks, I thought I’d share my thoughts here.

As I’ve written before, if you invest, you’re going to lose money at some point. That’s ok–especially when you’re young, because time helps mitigate loss if you have a good investment. But ideally, it shouldn’t be happening very often, and when it does, it still sucks.

Now check this out: I was listening to some personal-finance pundits talking about the recent down market, and more than one of of them said the equivalent of, “If a stock drops 8% (or 10%, or 12%), I’m out of there.” What the hell?

Here’s the example one of them gave. Try to figure out the answers before you go on:

“If your stock does down from 100 to 50, what percentage have you lost?Answers: It’s gone down 50% and it has to increase 100% just to break even. (If it only increased 50%, it would be at 75.) Most beginning investors get this wrong.

Now, to get back up to 100, what percentage does your stock have to increase?”

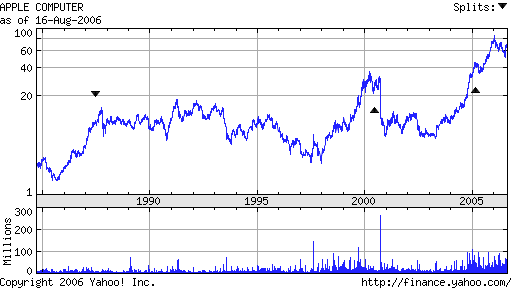

It’s a good lesson, but I think one-size-fits-all advice is dumb. I went roaming around to find some data to prove otherwise, so check out this Apple graph I took from finance.yahoo.com:

Now, let’s just eyeball it. Clearly, the stock has done very well in the last few years. But let’s look at the period from 1995-1998, during which time Apple dropped from about 17 to about 10. That is a big, big loss of about 41%.

But because I cherry-picked this example to prove my point, I know that’s not the whole story. Apple closed at $67.98 yesterday, and it’s split twice since that low point in 1998.

Now there are a few things about this example: First, if you really think stock-picking is about looking at charts and guessing–especially retroactively–then you are going to lose a lot of money for being a moron. This is just a superficial analysis to give an example. Second, had you sold when Apple was down, you would have missed out on a lot of money.

“But Ramit,” you might say, “I wouldn’t know it was going to go up at that time! I did the best I could.” Well, true. In hindsight, everything’s clearer.

“But Ramit,” you might say, “when should I sell a stock then?” I’ve written about that here.

“But Ramit,” you might say, “what are you saying? You told us you lost a lot of money. So are you just going to let your money sit there? Isn’t this just an excuse for being lazy and overly optimistic that your stock picks are really good?” Now this is a good question. It’s possible I’m committing lots of cognitive and decision-making errors. What you need to ask yourself is, “Are these still good companies and good investments?” If so, and you have the risk tolerance and time to ride the storm, great.

If not, your options are more limited, which is why it pays to invest earlier. In fact, if you think the companies are good companies, they’re on sale right now.

-

- If you missed the best 5 days of that 10-year period, your return would be down 22.65%.

- If you missed the best 10 days, your return would be 37.65%

- And it just gets worse for missing the best 15, 20, and 30 days of a 10-year period.

If you think you can figure out exactly when those 10 days will fall in 10 years, then you are much smarter than I am. Don’t try to time the market.

But don’t just sit around, either: If you suffer a relatively big loss in your portfolio (how big? you’ll know when it happens), it would probably be dumb to just saunter around outside with your hands in your pockets, whistling and skipping. Take some action:

1. I spent part of last weekend doing an analysis on my current holdings to see if they still meet my investment criteria. (They do, except one company, which I’m not sure I would invest in knowing what I know now.)

2. If I had properly diversified my investments, I wouldn’t have been hit as hard as I was. I’d been meaning to diversify into more non-tech stuff, including international funds, so I’m treating this as a kick in the ass to get this done. If you already have stocks, you can do this by either adding more money in different areas, or shifting current holdings to new areas.

3. Also added to my to-do list: Writing about decision-making theory and cognitive biases sometime in the future.

No comments:

Post a Comment

Thanks for visiting the blog. Your comments are welcome.